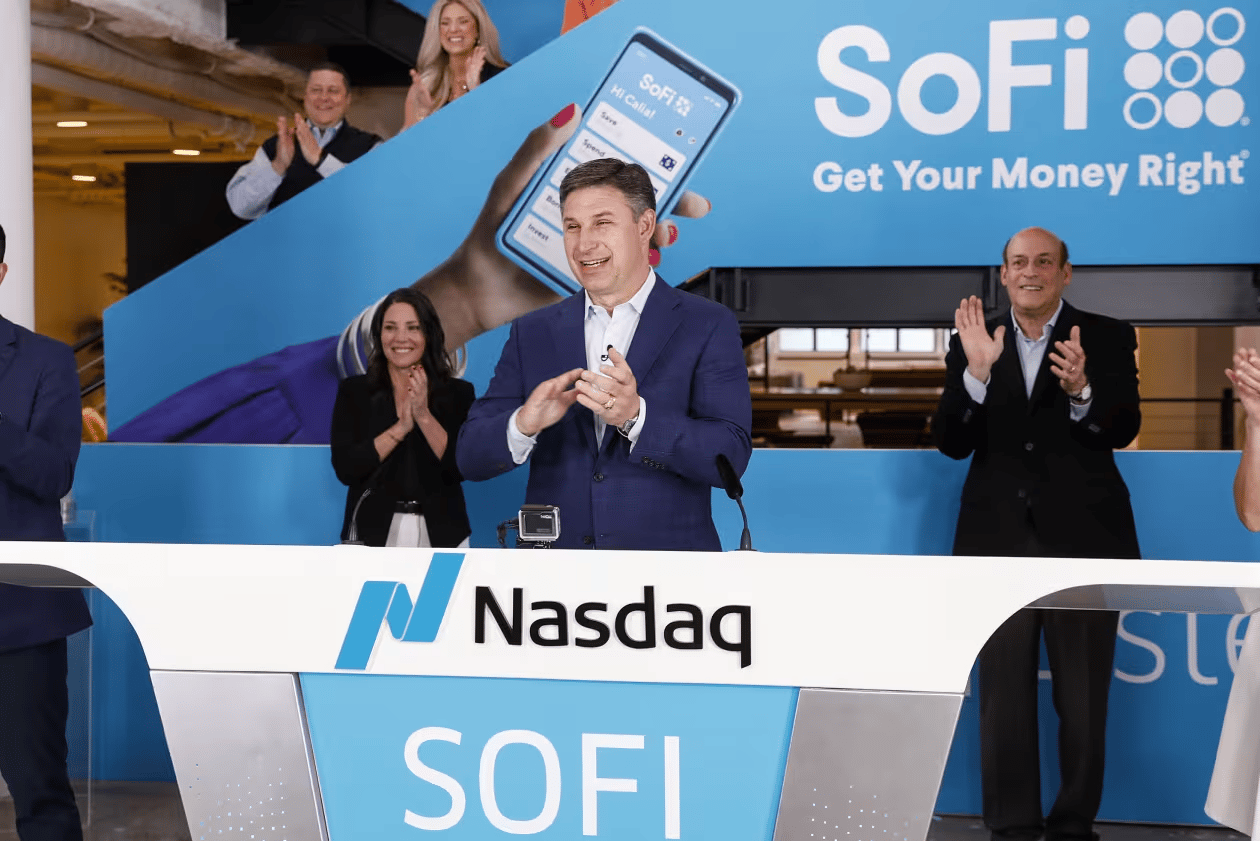

Photo: Market Watch

Fintech icon SoFi (SOFI) casually dropped a $1.5 billion stock offering plan on Thursday — because why not? The announcement comes right as the company’s market cap has nearly doubled in 2025. Cheers to that!

The company says this fresh round of stock offerings is all about fueling bigger, better investments moving forward — and honestly… fair. When you’re on a roll, you don’t exactly slow down.🔥

Back in October, SoFi reported some truly impressing results, with revenue jumping 38% year-over-year, and net income nearly doubling. Oh, and the stock itself? It’s up more than 6x since 2022. Yep, SIX TIMES! 📈

But SoFi isn’t just riding momentum — it’s building an entire fintech empire while it’s at it.

During that October earnings call, the company casually rolled out an ambitious list of upcoming products to truly cement their position as a leader in finance:

A blockchain-enabled remittance service called SoFi Pay 🔗

A full crypto trading relaunch, letting users buy, sell, and hold dozens of tokens directly inside the app 📲

A SoFi-branded stablecoin planned for 2026 🪙

An AI-powered “Cash Coach” to help users manage money smarter 🤖

And an upcoming SoFi Smart Card with rewards + credit-building features 💳

So yes, ambitious indeed!

Of course, Wall Street did what Wall Street always does when dilution enters the chat. The stock dropped more than 7% in after-hours trading after the offering was announced. Cue the panic, dramatic headlines, and “is it over?” posts. 📉

But step back and look again.

Analysts aren’t exactly losing sleep over this one. Many see the drop as a normal short-term overreaction — and some are even calling it a buy-the-dip moment.

After all, this is the same company that’s consistently beat expectations, expanded aggressively, and not only survived but thrived through multiple market cycles. ✅

Yes, dilution stings. But growth costs money. And SoFi is clearly planning for tomorrow.

So, this move might wobble the stock in the short term, but long term, it looks like SoFi is still playing offense, not defense. And if history is any guide, betting against the company hasn’t exactly been a winning strategy.